We lead pre-seed and seed rounds, providing capital and access to our network of enterprise software buyers. Our Fortune 500 Limited Partner network gives us a unique edge—helping us spot market shifts and enabling our founders to win customers and scale category-defining businesses.

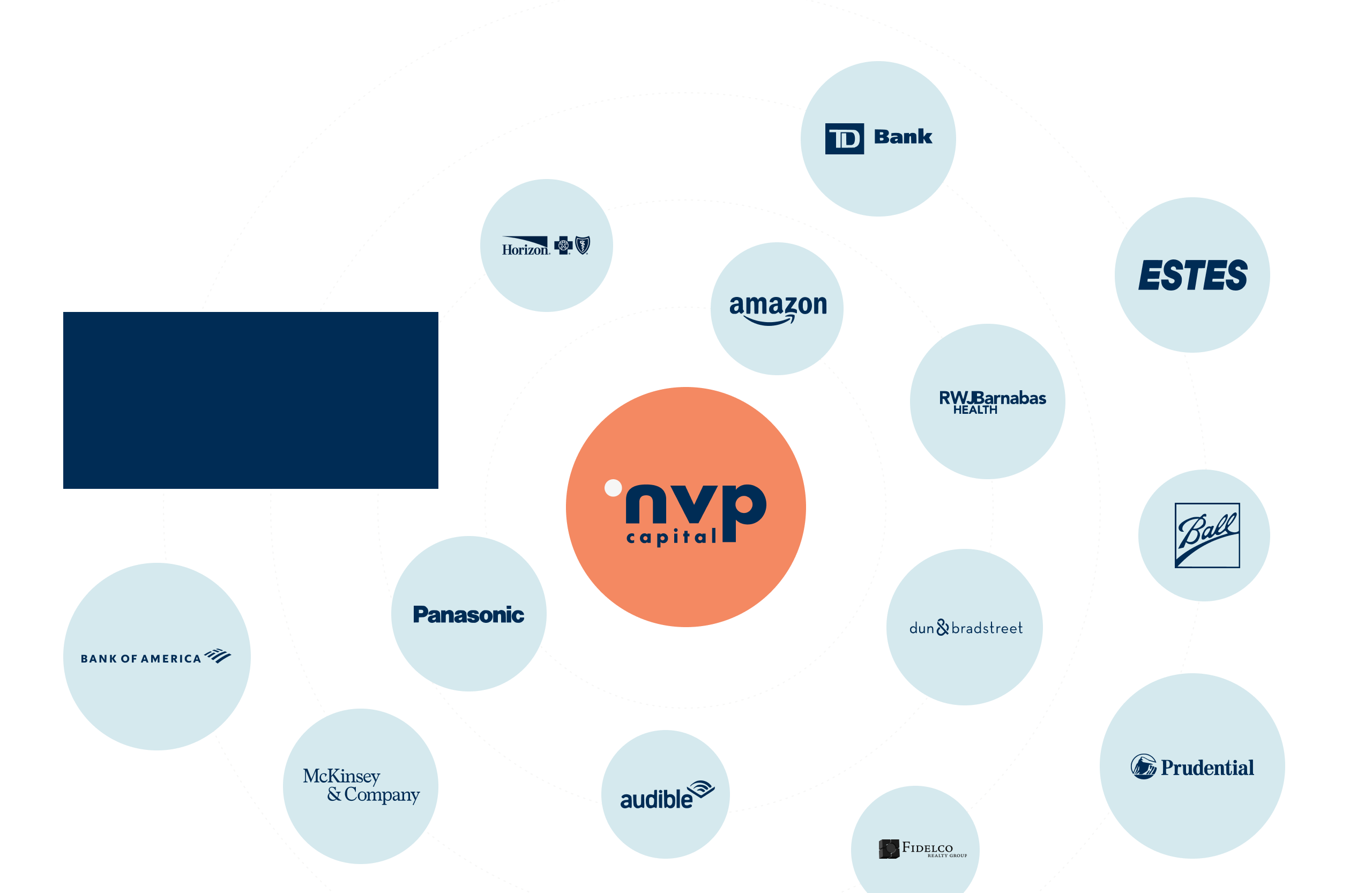

We have over 35 trusted and highly engaged corporate partners that mentor our founders, review and champion products, and share insider insights on marketplace trends